crypto tax calculator uk

Cryptocurrency gains of 20000 staking income of 2000 with a salary of 50000. Calculating cryptocurrency in the UK is fairly difficult due to the unique rules around accounting for capital gains set out by the HMRC.

Track Your Cryptocurrency Portfolio Taxes Cointracker Is The Most Trusted And Secure Cryptocurrency Portfolio Tr Tax Guide Cryptocurrency Buy Cryptocurrency

In both the 202122 and 202223 tax years UK residents are given an annual capital gains tax allowance of 12300.

. Now that you are clear on how to use our crypto tax calculator and what taxes you will pay on crypto consider how. This calculator is for any crypto traders operating as a business or professional trader. To calculate tax on crypto-to-crypto transactions you have to calculate the value of each crypto in fiat.

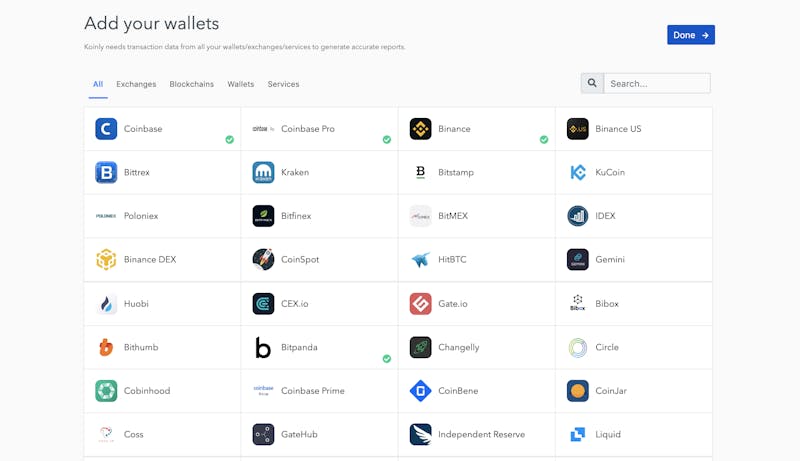

Crypto CPAs in UK. Full integration with popular exchanges and wallets in Canada with more jurisdictions to come. Its important that you report your profits accurately and pay any tax due by the deadline if you want to avoid financial penalties.

270 taxed at 20 54. We have a list of certified tax accountants in the UK that specialise in cryptocurrencies. In simple terms this means that unless.

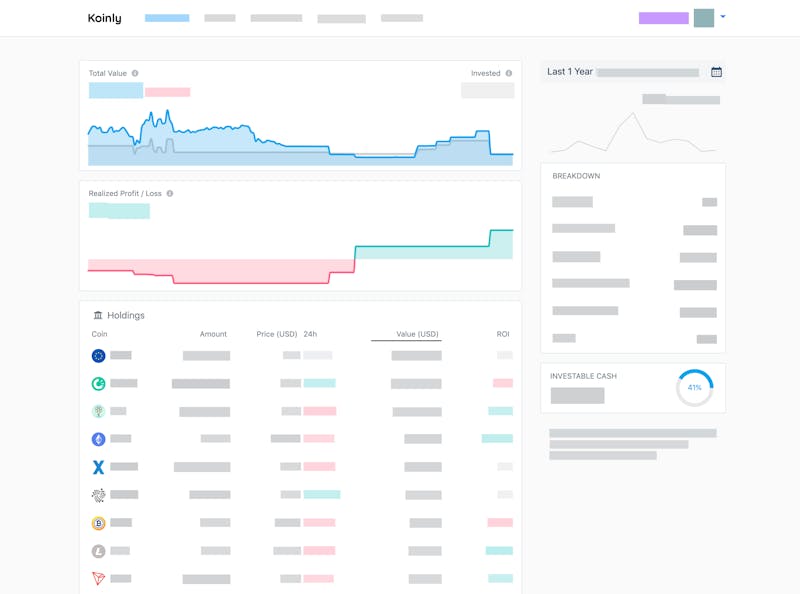

Koinly has helped hundreds with their crypto. The tax rate on this particular bracket is 325. In the UK the tax year starts on April 6th and ends on April 5th of the following year.

Using a tax calculator for your cryptocurrencies will not only make it easier for us to help you but it can also save you valuable time and money. Your Earnings Annual Salary Other Income Sources Gains from Crypto Sales Gains from Exchanging One Currency For Another Income from Staking Income from Mining Income from Air Drops Income from Other. Anyone in the UK who has had dealings with cryptocurrencies may need to pay tax.

The tax rate on this particular bracket is 325. Private by design - all data encrypted by you and never seen by us or anyone else. We do not offer final financial year reporting in the free trial.

For the 2021-2022 tax year the paper deadline is October 31st 2021 and the online deadline is January 31st 2022. File your crypto taxes in the UK Learn how to calculate and file your taxes if you live in the United Kingdom. Capital Gains Tax is a tax you pay on your profits.

Best Crypto Tax calculator in the UK. Calculate and report your crypto tax for free now. Koinly is the most popular software to calculate crypto taxes.

Capital gains tax report. Trading and Property Allowance. If youve got income from both you can get 2000 tax free.

Best Crypto Tax Calculators in the UK. UK crypto investors can pay less tax on crypto by making the most of tax breaks. What is the deadline for reporting my crypto taxes.

Crypto Tax Calculators annual subscription ranges from 49 to 399 and supports up to 100000 transactions. Janes estimated capital gains tax on her crypto asset sale is 1625. If youre not sure whether you need to pay tax or how much tax you will need to pay weve got.

Crypto tax calculator software lets the users connect or import their cryptocurrency transaction data mainly the purchase price sale price and the crypto tax calculator tool automatically provides the gains or loss and other relevant information to populate your tax reports. UK Crypto Tax Calculator. CSV support if your exchange is dead.

Total income tax to pay 346. Koinly is a popular platform with a crypto tax calculator available in over 20 countries including the UK. Get started for free.

You can also generate an Income report that shows your income from Mining Staking Airdrops Forks etc. It helps you calculate your capital gains using Share Pooling in accordance with HMRCs guidelines. Coinpanda generates ready-to-file forms based on your trading activity in less than 20 minutes.

Crypto tax breaks. The free trial is available for 30 days. For the purpose of estimating Janes CGT tax on her crypto asset alone we then apply this 325 tax rate to the 5000 capital gain included in Janes assessable income.

Youll then need to file and pay your Capital Gains Tax bill by 31st January each tax year. 7700 taxed at 20 1540. FTX Binance Coinbase Kraken Luno Uphold and many more.

The rate of CGT that you pay each year depends on the asset youve sold and how much you earn. Trading allowance of 1000 0. Since then its developers have been creating native apps for mobile devices and other upgrades.

1000 of income from trading or property is tax free thanks to the Trading and Property Allowance. CoinTrackinginfo - the most popular crypto tax calculator. This list is compiled out of the best available.

There are plenty of crypto gains calculators available on the market. This manual sets out HMRCs view of the appropriate tax treatment of cryptoassets based on the law as it stands on the date of publication. With over 300000 users CoinTrackinginfo is one of the oldest and most trusted cryptocurrency tax calculators on the market today.

HMRC has published guidance for people who hold. Crypto Tax UK Guide for 2022. 0325 5000 1625.

Straightforward UI which you get your crypto taxes done in seconds at no cost. 12570 Personal Income Tax Allowance. The free trial allows you to import data review transactions see a full breakdown of calculated taxes against each transaction and review the dashboard.

You declare anything youve earned from selling an asset over a certain threshold via a tax return. To calculate your capital gains as an individual the HMRC requires you to keep track of your average cost basis for the token on hand aggregate your same-day transactions and ignore any wash sales. Koinly helps UK citizens calculate their crypto capital gains.

Total CGT to pay 1540. Your tax authority wants to know your equivalent profits or losses in the local fiat USD GBP AUD or CAD. The platform is also to start using Koinlys crypto tax calculator.

UK citizens have to report their capital gains from cryptocurrencies. Capital Gains Tax Allowance on Crypto. The deadline for submitting your tax return is different for paper and online submissions.

730 taxed at 40 292. If youre looking to get started with a UK crypto tax calculator right away one of the following options is. The original software debuted in 2014.

Capital Gains Tax allowance of 12300 0. We offer a free trial so you can try our service and get comfortable with how it works. Automated Crypto Trading With Haru.

We have listed down 4 of the best crypto tax calculators in the UK.

Calculate Your Net Income Manitoba Give Tax Rates Pensions Contributions And More Income Tax Net Income Income

Top 10 Uk Exchanges To Get Crypto Tax Reports Koinly

Calculate Your Crypto Taxes With Ease Koinly

How To Calculate Your Uk Crypto Tax

Best Crypto Tax Software Top Solutions For 2022

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

Calculate Your Crypto Taxes With Ease Koinly

Bitcoin Tax Calculator Easily Calculate Your Tax Obligation Zenledger

Cryptocurrency Tax Guides Help Koinly

Crypto Tax Calculator Overview Youtube

How To Calculate Cost Basis In Crypto Bitcoin Koinly

Calculate Your Crypto Taxes With Ease Koinly

Crypto Taxes Hmrc Eofy Tax Deadline 31st Jan 2022 Koinly

How To Calculate Crypto Taxes Koinly